Czech Republic

Autogas market trends

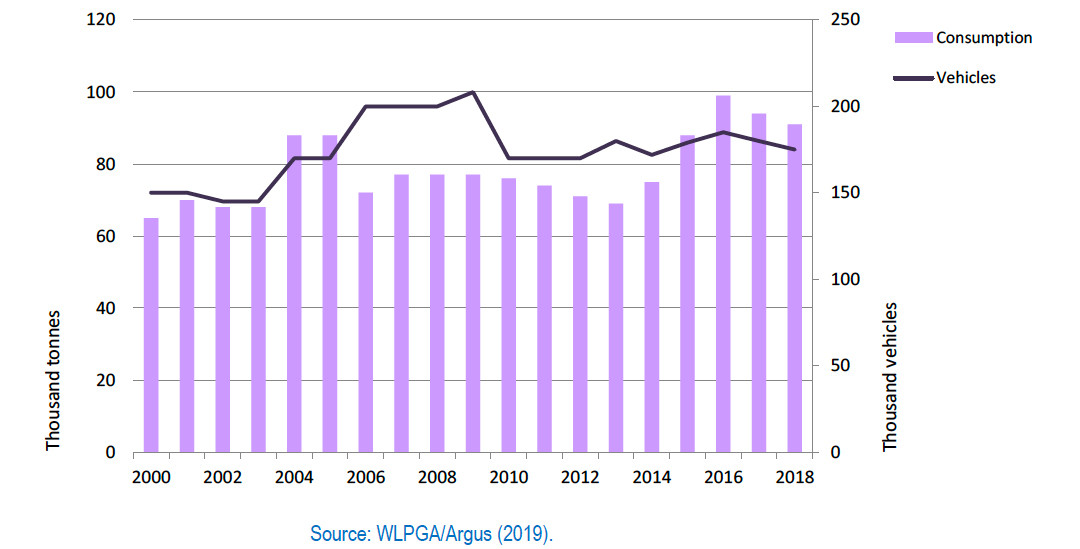

After several years of stagnation, the Czech Autogas market rebounded strongly in 2014-2016, though it has since contracted once again. Consumption peaked at 99 000 tonnes in 2016 and then fell to 91 000 tonnes in 2018; for most of the period 2006-2013, it had hovered at around 70 000 to 80 000 tonnes per year (Figure B5.1). The surge in the market to 2016 was driven by an increase in the number of high-mileage Autogas vehicles, mainly taxis and commercial fleet LDVs, seeking to take advantage of a highly favourable taxation policy and relatively low prices at the pump. Autogas now accounts for around 1.5% of the country’s road-fuel needs and 22% of total LPG use.

Figure B4.1: Autogas consumption and vehicle fleet – Czech Republic

Most Autogas vehicles are converted gasoline cars, but sales of OEM vehicles are growing with several models on offer from six carmakers: Kia (Venga model), Opel (Adam, Mokka, Meriva and Zafira), Mitsubishi (Outlander), Hyundai (i10 and ix20), Dacia (Logan, Sandero, Lodgy, Duster and Dokker), and Fiat (Panda, Punto, 500L and Tipo). The number of vehicles that can run on Autogas hit a recent peak of 185 000 in 2016, but fell back to 175 000 in 2018 (about 3% of the total vehicle fleet). The CNG fleet has also been growing, but remains far smaller with around 14 000 vehicles in operation in 2016, including buses and light-duty trucks. There are 936 filling stations that sell Autogas across the country – about one-fifth of the total.

Government Autogas incentive policies

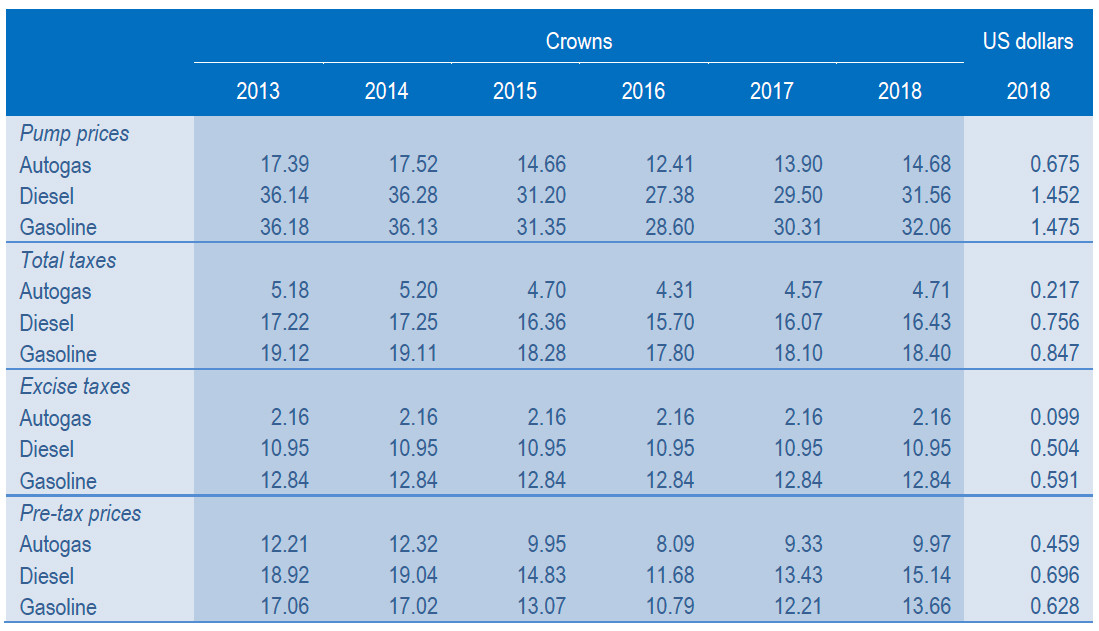

The sole government policy to support Autogas is a very low excise duty of the fuel compared with gasoline and diesel. The tax has been constant at 3.93 crowns per kilogramme (2.16 crowns per litre) since 2004. The tax on gasoline and diesel, which last increased in 2010, amounts to 12.84 crowns and 10.95 crowns respectively (Table B5.1). This resulted in an Autogas price at the pump in 2018 that was just 46% of the price of both gasoline and diesel, though this price advantage has narrowed slightly since 2016. In contrast to electricity chargers and CNG infrastructure, the government provides no financial incentives or support for Autogas distribution infrastructure.1

Table B4.1: Automotive-fuel prices and taxes per litre – Czech Republic

Competitiveness of Autogas against other fuels

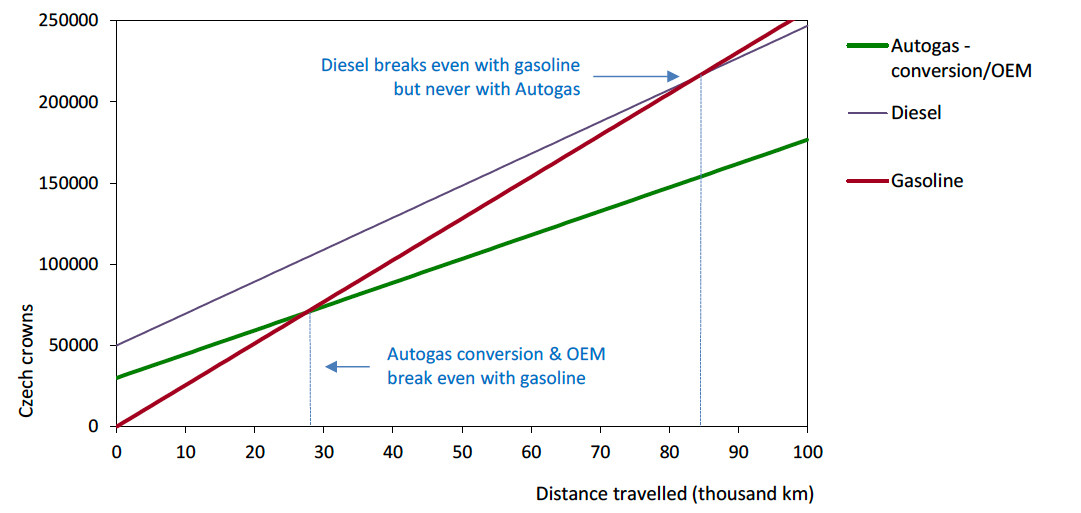

The low price of Autogas makes it by far the cheapest fuel in terms of cost per kilometre among the three leading fuels. Based on an average cost of conversion of 30 000 crowns (around $1 200) and a similar amount for the price premium of an OEM Autogas car over a gasoline-powered model, the break-even distance is just 28 000 km, or about two years of driving for the typical private motorist (Figure B5.2). The fuel-cost savings after 100 000 km amount to about 80 000 crowns ($3 700). Diesel breaks even with gasoline at around 85 000 km (based on a price premium of 50 000 crowns, or $2 000), but is never competitive with Autogas.

Figure B5.2: Running costs of a non-commercial LDV, 2018 – Czech Republic