Canada

Autogas market trends

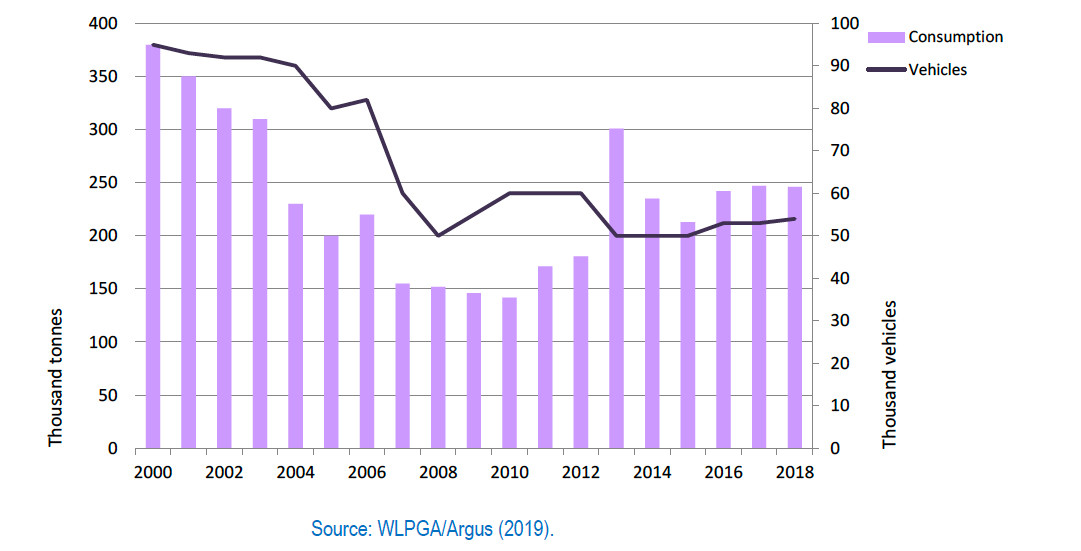

The Canadian Autogas market went into decline in the early 1990s after a decade of growth. Autogas use peaked in 1992 at around 700 000 tonnes and then fell to less than 150 000 tonnes in 2010. The market has since picked up strongly, reaching 246 000 tonnes in 2018 (Figure B3.1). Yet Autogas still accounts for just 0.2% of total automotive-fuel use. The initial slump in Autogas use was a direct result of the declining number of Autogas conversions in fleets, primarily due to increased conversion equipment costs and the removal of federal conversion grants. The recent rebound in demand is largely due to a fall in the price of Autogas relative to that of gasoline and diesel (at least until 2017) and federal incentives (see below).

Figure B3.1: Autogas consumption and vehicle fleet – Canada

The majority of the estimated 54 000 Autogas vehicles in use in Canada today are high-mileage public fleet vehicles, mainly converted vans and school buses. At present, no OEM Autogas vehicles are marketed in Canada. Alberta, Ontario and British Columbia have the largest Autogas markets. Autogas is available at about 2 250 filling stations across Canada – a very high number relative to the number of vehicles in use. Refuelling infrastructure is larger than that of any other alternative fuel in Canada.1

Government Autogas incentive policies

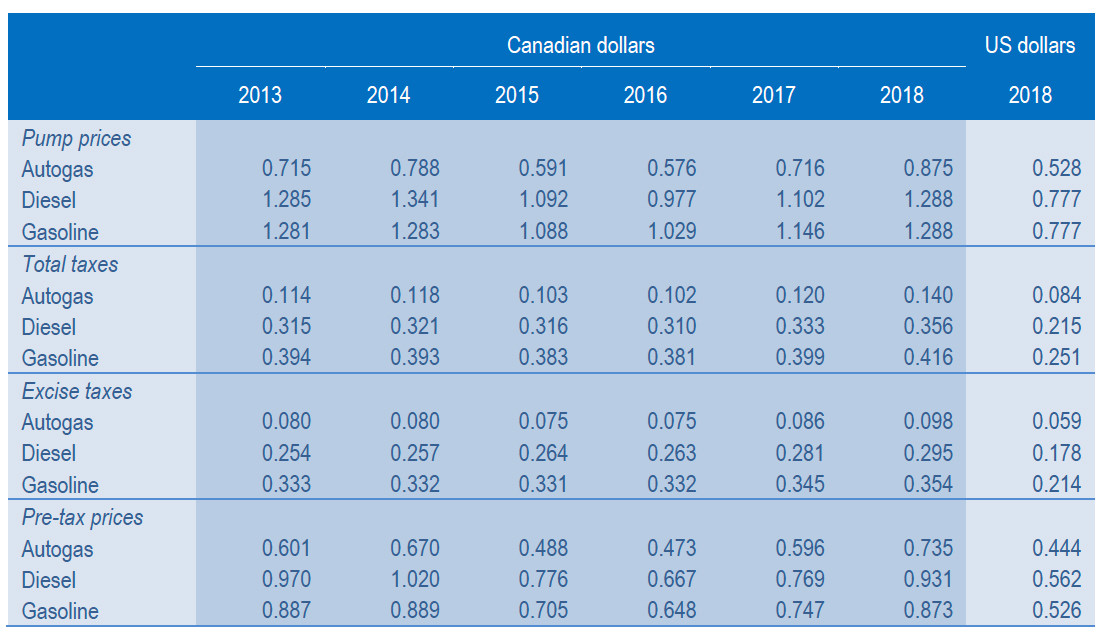

Autogas enjoys a significant per-litre tax advantage over gasoline and diesel, thanks to lower provincial taxes and no federal excise tax on Autogas. However, because fuel taxes across the board are relatively low in Canada, the differences in prices at the pump in absolute terms are not very large. The Autogas tax differential (including sales taxes) is currently just 21.6 Canadian cents/litre compared with diesel and 27.6 cents/litre compared with gasoline (Table B3.1). Tax rates on all three fuels have increased only marginally in recent years. The average pump price of Autogas in 2018 was 32% lower than that of both gasoline and diesel. Adjusted for differences in energy content per litre (and, therefore, mileage), Autogas is a bit cheaper than gasoline, but slightly more expensive than diesel.

Table B3.1: Automotive-fuel prices and taxes per litre – Canada

In practice, Autogas receives limited policy support in Canada. The Alternative Fuels Act 1995 requires that three-quarters of all vehicles purchased by the federal government be capable of operating on one of a range of alternative fuels, including Autogas, where it is cost-effective and operationally feasible. However, in practice, most of the AFVs purchased are gasoline-fuelled vehicles capable of running on blends of gasoline and ethanol with content of the latter of up to 85%.

Competitiveness of Autogas against other fuels

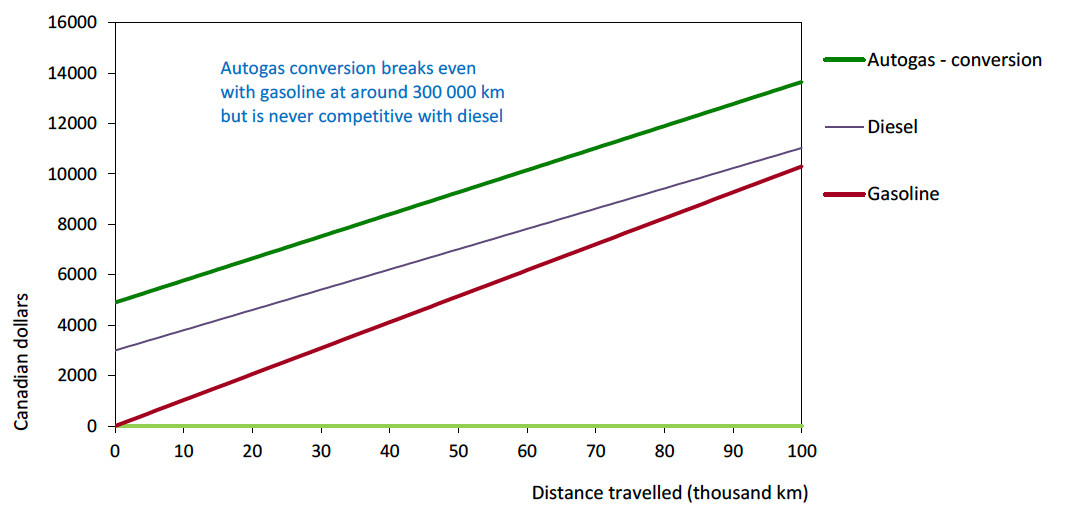

At present, the Autogas market – as in the United States – is driven entirely by federal fleet mandates: the fuel is not a financially-attractive alternative to either diesel or gasoline in Canada because of unfavourable taxation policies and a lack of incentives to convert or buy OEM Autogas vehicles. Conversion costs, at around CA$4 9oo for a typical 4-cylinder gasoline-fuelled vehicle are also relatively high in Canada, further undermining the competitiveness of Autogas. Autogas is never competitive with diesel and only breaks even with gasoline at around 300 000 km – well above the typical lifetime of an LDV. By contrast, diesel becomes competitive with gasoline at about 120 000 km.

Running costs of a non-commercial LDV, 2018 – Canada