Netherlands

Autogas market trends

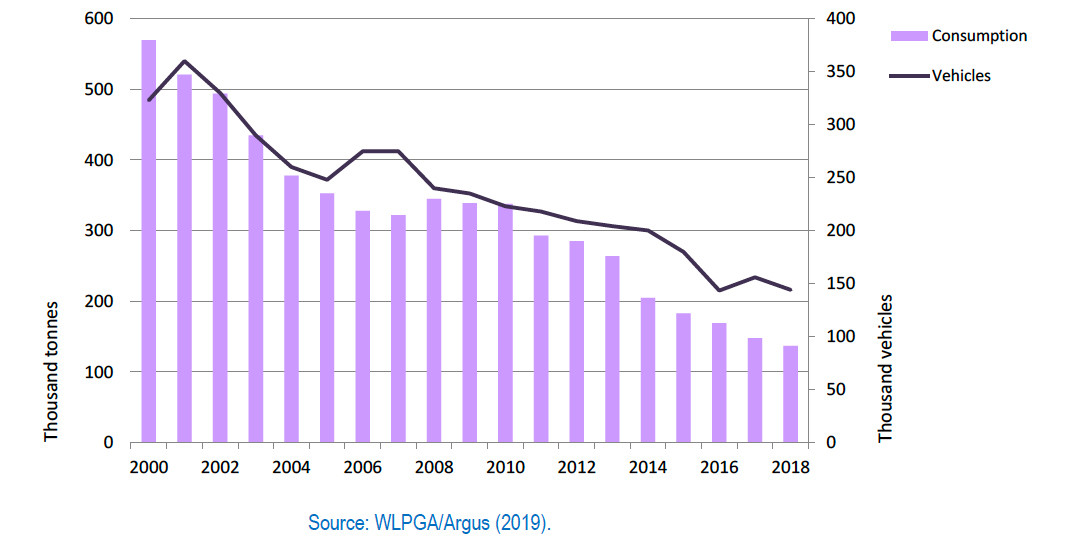

Autogas use in the Netherlands has a long history. The Dutch Government encouraged the use of Autogas and LPG generally for many years because the country, with a large refining industry, used to be a major producer and exporter of the fuel. The country is now a net importer of LPG, so the rationale for encouraging Autogas now is purely environmental. But demand has been declining for many years, as policy support for the fuel has waned and as priority has shifted to encouraging natural gas (CNG and LNG) and EVs, even though Autogas remains highly competitive. Autogas consumption fell further in 2018, to 137 000 tonnes – 7% down on 2017 and 76% lower than in 2000 (Figure B15.1). Autogas now meets just 1.4% of the country’s total road-fuel demand.

Autogas consumption and vehicle fleet – Netherlands

Apart from a short-lived recovery in 2006, the Autogas vehicle fleet has been contracting almost without a break since the early 2000s. At end-2018, there were 144 000 Autogas vehicles in use – down from a peak of 360 000 in 2001. A hike in the excise tax on Autogas that took effect at the beginning of 2014 alongside much smaller increases in the tax on gasoline and diesel has driven down consumer interest in buying OEM Autogas cars or converting an existing car to run on the fuel. Only three carmakers – Chevrolet, Dacia and Opel – still offer Autogas versions, even though the prices are often not much more (and in some cases lower) than those of gasoline-powered equivalents and are much cheaper than diesel cars thanks to lower purchase taxes (see below). There are 1 650 refuelling sites that sell Autogas across the country, close to half of the total.

The fleet of other types of alternative fuels is expanding. The number of EVs, including hybrids, on the road in the Netherlands has been growing very rapidly in the last few years, and the fleet, at 148 000 vehicles at end-2018, is now slightly larger than for Autogas. The CNG fleet has also been growing, but is much smaller than that for Autogas, made up mostly of HDVs and municipal fleet LDVs.

Government Autogas incentive policies

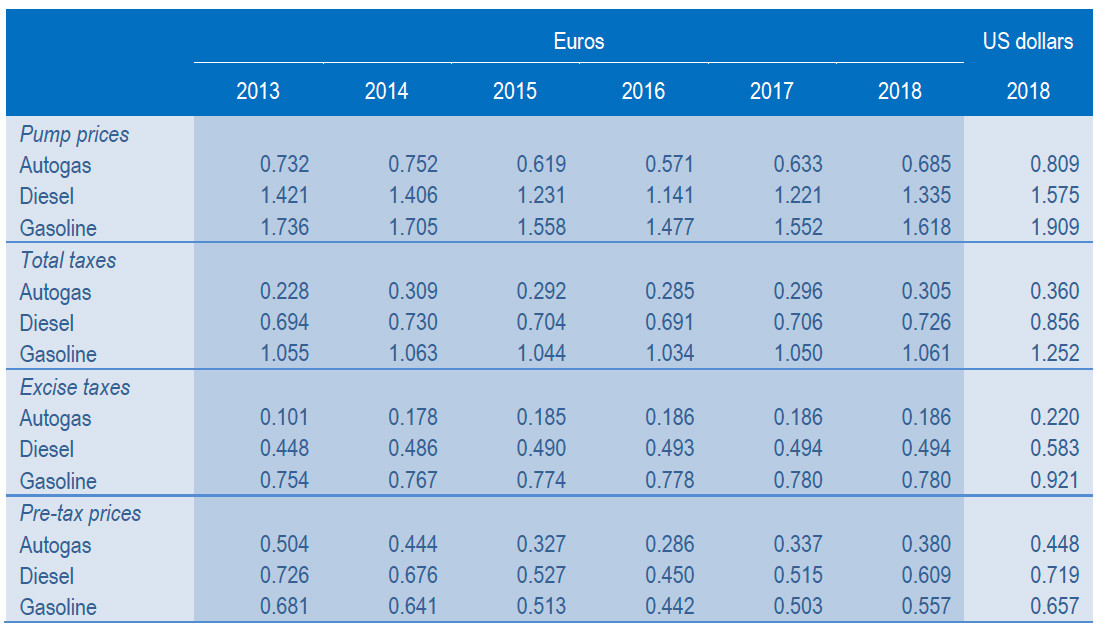

The Dutch government maintained a policy of encouraging the use of Autogas through fuel and vehicle tax incentives for many years. The excise tax on Autogas was raised almost every year between 2007 and 2013, but by less in absolute terms than the taxes on gasoline and diesel, widening the gap in final prices (Table B15.1). In 2014, the tax on Autogas was increased sharply, causing the price gap to narrow suddenly; it has risen very slowly and more-or-less at the same rate as those on gasoline and diesel since then (there was no change in 2018). The tax currently stands at 18.6 cents/litre, compared with 49.4 cents on diesel and 78 cents on gasoline. The pre-tax price of Autogas also remains much lower than that of the other two fuels in per-litre terms. As a result of this and the lower excise tax, the price of Autogas gas at the pump in 2017 was equal to just 42% of the price of gasoline and 51% of the price of diesel. In absolute terms, Autogas was 93 cents/litre cheaper than gasoline and 65 cents cheaper than diesel. These differences narrowed significantly compared with 2017.

Automotive-fuel prices and taxes – Netherlands (euros/litre)

There are no grants or tax credits available for Autogas conversions or OEM purchases. However, the vehicle-purchase tax (known as the luxury tax) is significantly lower than for diesel cars (and the same as for gasoline cars).1 On the other hand, the annual vehicle (road) tax, known as the holdership tax, for Autogas vehicles is higher than for both gasoline and diesel vehicles (except for the lightest vehicles). For example, the tax rate for a car weighing one tonne is €304 per year for gasoline, €676 for diesel and €724 for Autogas. The rates of the luxury and holdership taxes have not changed for several years. On 1 January 2017, the benefit-in-kind tax for company cars was harmonised at 22% of the list price for all fuels, with the exception of EVs. Previously, Autogas cars incurred a higher rate. The tax on EVs is 4% up to €50 000 and 22% for the additional cost above that.

The Dutch LPG industry has called for Autogas to be allowed to be sold on unmanned refuelling sites, which is currently not permitted. There are signs that this ban may be lifted, but it may require two years to take effect.

Competitiveness of Autogas against other fuels

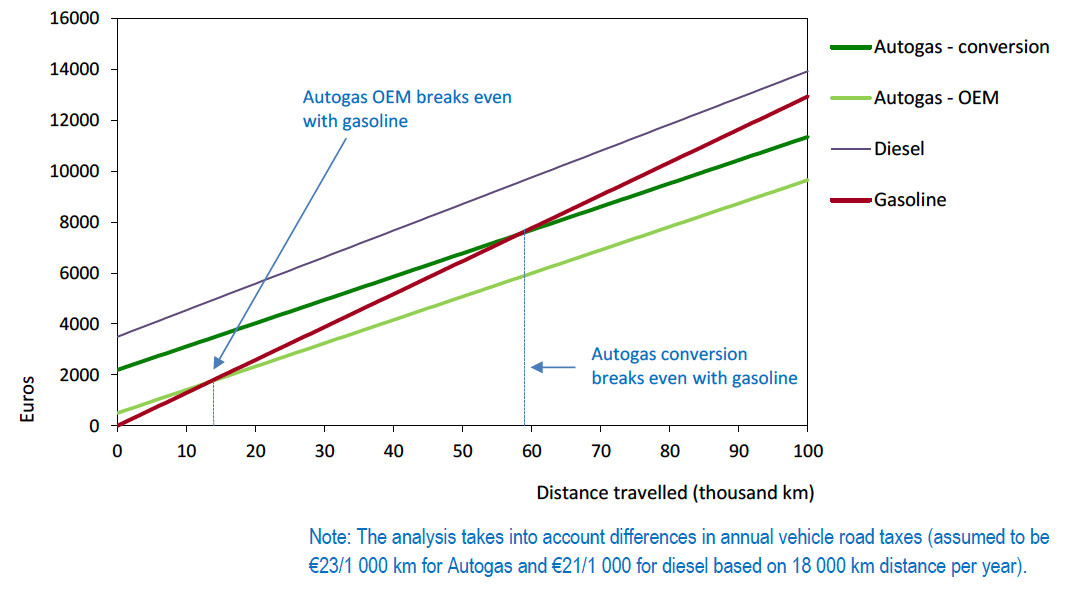

The relatively low pump price of Autogas resulted in a breakeven distance for Autogas against gasoline of around 9 000 km for an OEM Autogas LDV (based on a typical price premium of just €500 over a gasoline car thanks in part to a favourable the luxury tax) and 37 000 km for converted vehicles (assuming an average cost of installing a conversion kit of €2 200) in 2018 (Figure B15.2). These distances have barely changed in recent years. The calculations take account of the higher annual road tax on Autogas vehicles. Autogas is always more competitive than diesel (regardless of distance) as a diesel LDV costs much more than an equivalent gasoline model (€3 500 on average) and per-km fuel costs are higher.

Running costs of a non-commercial LDV, 2018 – Netherlands