Lithuania

Autogas market trends

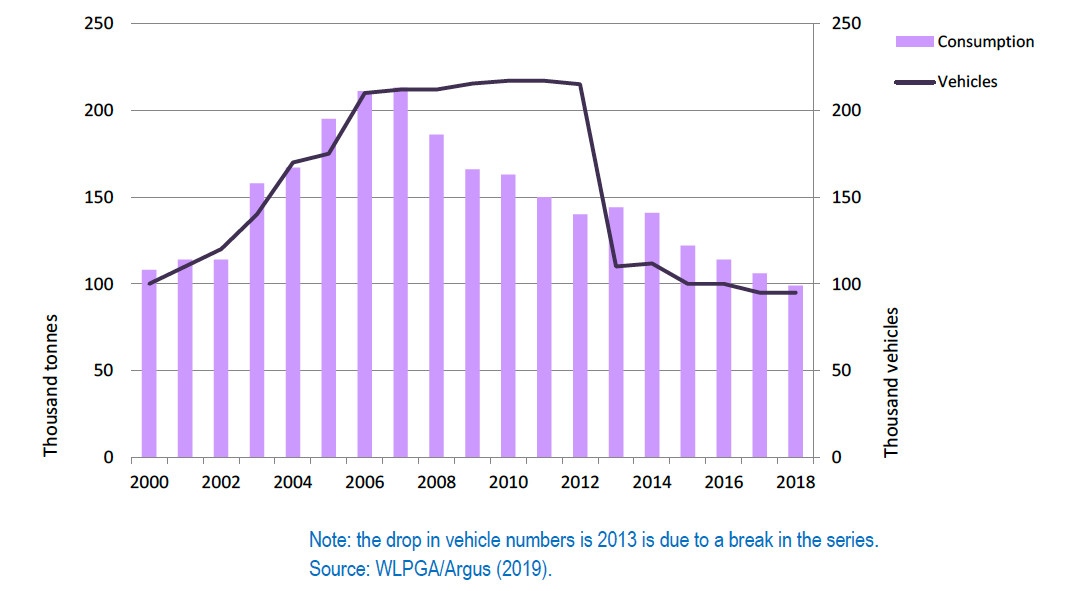

Lithuania has a large Autogas market relative to the size of the country thanks to a traditionally favourable fuel-tax policy, though it has contracted markedly over the last decade. Consumption fell steadily from a peak of 213 000 tonnes in 2006 to just 99 000 tonnes in 2018 – its lowest level for 20 years (Figure B13.1). Autogas met roughly 6% of the country’s total automotive-fuel needs and accounted for 70% of total LPG consumption in 2018.

Autogas consumption and vehicle fleet – Lithuania

Despite the big fall in fuel sales, the Autogas vehicle fleet has contracted only marginally in recent years, totalling 95 000 at end-2018. A similar range of factory-fitted OEM models as in neighbouring Poland are available, distributed mostly by Polish companies. Conversions of existing gasoline-powered cars are common. There are an estimated 390 refuelling sites throughout the country.

Government Autogas incentive policies

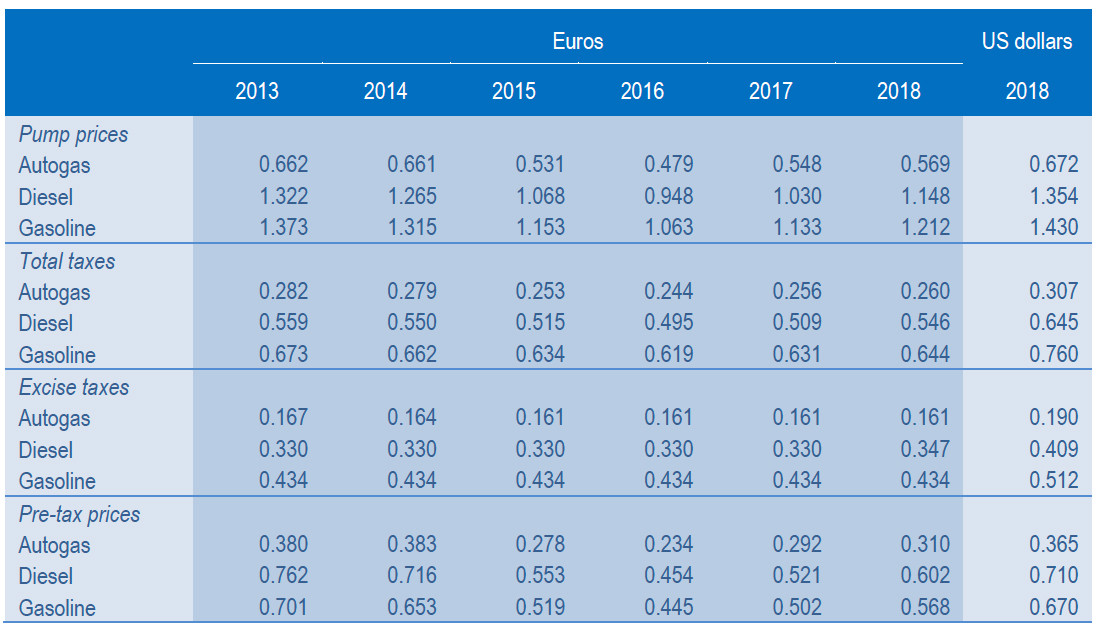

Autogas use is encouraged solely through a strong fuel-tax incentive. The excise duty on autogas, at 16 euro cents/litre, is a little over one-third of that on gasoline and less than half that on diesel (Table B13.1). Excise duties on all three fuels have not changed since 2011, with the exception of a small increase in that on diesel in 2018. Combined with a relatively low pre-tax price, the pump of Autogas in 2018 was just 47% of that of gasoline and 50% that of diesel.

Automotive-fuel prices and taxes – Lithuania (euros/litre)

Competitiveness of Autogas against other fuels

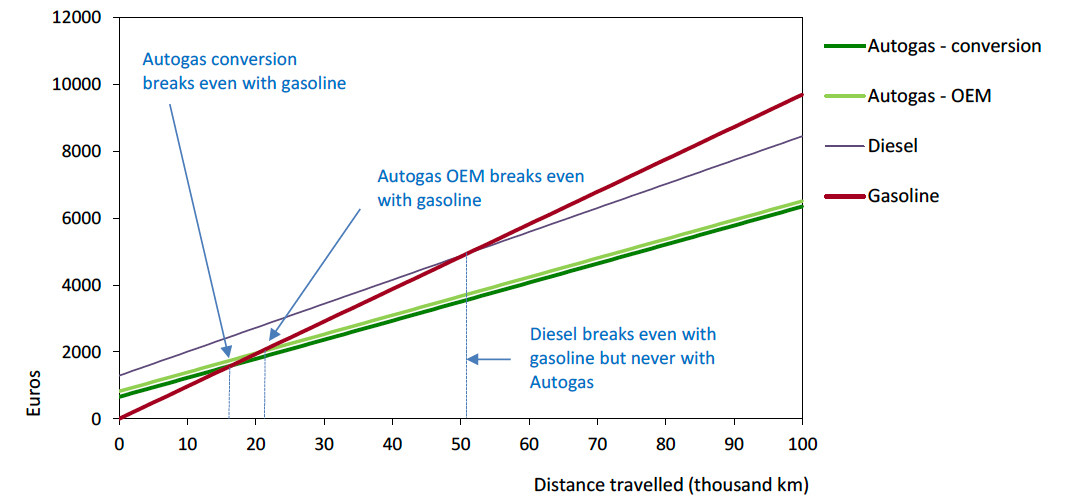

Autogas is extremely competitively priced in Lithuania. The break-even distance for Autogas against gasoline is estimated at around 17 000 km for a converted Autogas LDV and 21 000 for an OEM vehicle based on 2018 fuel prices and vehicle costs (Figure B13.2). This assumes an average conversion cost of about €700 and an average price premium for an OEM vehicle over a new gasoline one of around €800.

Running costs of a non-commercial LDV, 2018 – Lithuania

Autogas is always competitive against diesel, both because running costs are lower and because the conversion cost and OEM price premium are less than the higher vehicle-acquisition price of a diesel vehicle. The net financial savings to the owner of a converted Autogas vehicle for a distance of 100 000 km amount to around €3 350.