A Global Roadmap for Autogas

Autogas is affordable

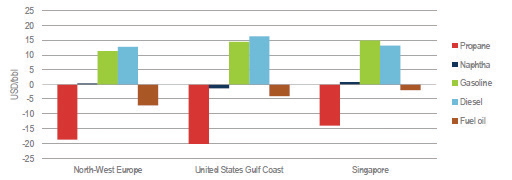

Most alternative fuels have struggled to compete with conventional ones until now because they are more expensive; Autogas is the exception. The cost of converting vehicles and fuel-distribution infrastructure is generally lower than for other non-blended alternative fuels. And the fuel itself is highly affordable: on an energy- content basis, the cost of bulk LPG delivered to service stations is usually lower than that of gasoline or diesel, reflecting price differentials on international markets, as well as natural gas and biofuels. In volume terms, LPG is traded at an average discount of around US$30 per barrel to gasoline and diesel in Europe, US$35/barrel on the US Gulf Coast and close to US$30/barrel in Singapore in 2017 (Figure 6). Rising demand for Autogas is not expected to raise the cost of LPG on the international spot market relative to gasoline in the coming years given the abundance of supplies – even if demand for Autogas continues to rise (see below).

Converting vehicles to run on Autogas is easier and less costly than for most other alternative fuels like natural gas or electricity. Conversion costs for LDVs range from about US$500 in some developing countries to US$4 000 in North America, but are little more than US$1 500 in most cases (WLPGA/ Liquid Gas Europe, 2018). The premium for a dual-fuelled OEM vehicle also varies considerably: it used to be at least $1 000 in most countries and sometimes a lot more. But the premium has fallen sharply in some countries in the last few years, as some carmakers have cut the prices of their Autogas models to attract customers. In some cases, OEMs propose Autogas versions at the same price as gasoline versions (e.g. France and the Netherlands). In almost all countries, converting a gasoline car to Autogas – or opting for a dual-fuelled OEM Autogas vehicle – costs less than the price premium for a diesel car. Most conversions are for LDVs, though HDV conversions are becoming more commonplace (Box 4).

Figure 6: Average spot oil product price differentials with crude oil in selected locations, 2017

BOX 1: CONVERTING A VEHICLE TO RUN ON AUTOGAS

Autogas fuel systems are a proven and mature technology. Specialist companies have developed and market standardised Autogas conversion kits, including a parallel fuel system and tank, with specialist garages carrying out the installations. It involves some operational inconveniences, the most significant of which is the loss of boot/trunk space to accommodate the additional fuel tank. But the development of new technologies, including doughnut tanks and lightweight composite tanks, has helped to alleviate this problem for Original Equipment Manufacturer (OEM) vehicles, i.e. with factory- fitted dual-fuel systems, which represent the majority of new Autogas vehicles. For mainly technical reasons, most LDV conversions involve gasoline-powered spark-ignition engines, which are particularly well-suited to run on Autogas. However, it is also easy and relatively inexpensive to convert a light duty diesel engine to Autogas through the replacement of the cylinder head for a spark ignition one.

Sales of OEM Autogas vehicles, incorporating conversion kits at the point of manufacture, have been growing in many established markets in recent years. Most of the leading car manufacturers have introduced Autogas versions of at least one of their models, while others offer conversions at the time of sale, such that they are covered by their warranty (aftermarket conversions can sometimes invalidate the vehicle warranty). Worldwide, around 20 car brands currently market around 140 Autogas models (WLPGA, 2018). As Autogas has become more widely available, some OEM vehicle manufacturers have become involved in the development, design and manufacture of Autogas systems. They now produce and market dedicated Autogas vehicles with under-floor fuel tanks.

Converting a heavy-duty diesel engine in an existing vehicle can be technically more complex and expensive than converting a heavy-duty gasoline engine, but there are examples of Autogas being blended with the diesel fuel without changing the cylinder head. In recent years a number of heavy- duty Autogas spark-ignition engines (mostly adaptations of their diesel counterparts) have been commercialised by several of the larger engine manufacturers. These engines are used mainly in buses and mid-sized trucks, notably in the United States, Korea and China.

Source: WLPGA/Liquid Gas Europe (2018).

The cost of installing refuelling infrastructure and converting LDVs is significantly lower for Autogas, in large part because of the extra cost of CNG tanks (which need to be bigger and stronger because of their higher operating pressures). CNG refuelling stations are also much noisier than Autogas stations, making them undesirable in densely populated areas.

Table 2: Competitiveness of Autogas against compressed natural gas (CNG)

| wdt_ID | Autogas | CNG | |

|---|---|---|---|

| 8 | End-user price of fuel | Driven by the international LPG price (which follows other oil prices) but is generally lower than those of gasoline and diesel | Driven by bulk cost of delivered natural gas to major demand centres (low now in United States, but high in importing regions where the price is linked to that of oil) |

| 9 | Cost of refuelling infrastructure | Comparable to conventional fuels | Generally higher than for conventional fuels and Autogas as higher compression is needed; home refuelling costs are typically in excess of $10 000 |

| 10 | Cost of vehicle conversion (LDV) | Ranges from around $400 to $4 000 depending on the type of car, type of conversion and local market conditions | Generally much more expensive, partly because a bigger tank is needed to deliver the same driving range (in the United States, the cost ranges from $12 000 to $18 000 due to licensing requirements) |

| 11 | Ease of refuelling | Refuelling is rather quick and the fuel is generally widely available as it is easy to transport by road | Refuelling usually takes longer; the fuel is not always available in all areas as it must be piped |

The costs incurred in establishing or expanding an Autogas distribution network are also relatively low. These costs essentially relate to investments in service station storage and dispensing facilities. The plants and equipment that already exist to handle the importation, production, storage and bulk distribution of LPG for traditional uses are the same as for Autogas, although some additional investment may be needed to cope with higher throughput. Since Autogas generally makes use of the existing service station infrastructure for distribution of conventional fuels, additional costs for Autogas dispensing are low relative to some other alternative fuels. For example, the cost of installing a standard tank, pump and metering equipment for Autogas alongside existing gasoline and diesel facilities is typically around a third that of installing dispensing facilities for CNG with the same capacity. This is because of the added cost of dedicated supply pipelines, high-pressure compression, storage cylinders and special dispensers for CNG. In addition, the filling rate for CNG is much lower than for Autogas.

Despite the favourable environmental attributes of Autogas compared with other alternative fuels, the rate of switching to Autogas and overall consumption is highly dependent on the financial benefits to end users. A publicly- owned bus company may take account of the local environmental benefits as well as relative costs of different fuel options in deciding whether to switch to Autogas. But for most private fleet operators, truckers and individual motorists, the sole consideration is cost. As a result, private vehicle owners must be given an adequate financial incentive to switch to Autogas by converting their existing gasoline car or opting for Autogas when buying a new car: few people or companies are prepared to make a financial sacrifice individually to improve the environment for the common good. In practice, this means that the pump price in per-litre terms has to be well below that of both gasoline and diesel – typically less than half. That requires the government to tax Autogas less.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

“Converting a gasoline vehicle to run on Autogas – or opting for a dual-fuelled OEM Autogas vehicle – costs less than the price premium for a diesel car and usually much less than switching to most other alternative fuels like natural gas or electricity.”