A Global Roadmap for Autogas

The drivers of Autogas demand

The future of Autogas worldwide ultimately hinges on how well it can compete with both conventional fuels and other alternative fuels. Private motorists and the operators of commercial or public vehicle fleets decide which type of vehicle and fuel to use. These decisions are based on a number of factors, including vehicle performance, practicality, convenience and safety.

But cost is far and away the most important one: vehicle owners almost always opt for the cheapest fuel, even when it involves some drawbacks. So, for Autogas use to grow, it has to be competitive.

Government policies, particularly with regard to how much the fuel is taxed in relation to other fuels, are the primary determinant of the competitiveness of Autogas in the near term. In practice, how attractive Autogas is to the motorist compared with other fuels depends essentially on two factors: the net cost of converting an existing vehicle (or the extra cost of buying a factory-built Autogas vehicle compared with an equivalent gasoline or diesel vehicle) and the pump price of Autogas relative to diesel and gasoline. The vehicle owner needs to be compensated for the additional upfront cost through lower running costs, of which fuel is the most important. The time it takes for the savings in running costs to offset the capital cost – the payback period – depends on the usage of the vehicle, i.e. the average distance travelled monthly or annually. The payback period usually has to be less than two to three years to encourage commercial vehicle owners to switch; private individuals often demand an even quicker return on their investment.

The payback period – or breakeven distance – is very sensitive to the extent to which government incentives lower fuel costs relative to the other fuels and lower the upfront expenditure on the vehicle. Taxes on Autogas must be low enough relative to those on gasoline and diesel to compensate not just for the lower mileage of Autogas per litre (due to its lower energy content-to-volume ratio), but also to ensure that the pump price of Autogas is low enough to provide an incentive for motorists to switch fuels. In practice, the lower the relative rate of tax on Autogas, the lower the breakeven distance. Financial incentives directed at the vehicle itself, such as grants or tax credits for converting to Autogas, which exist in a few countries, also help to lower the distance (Box 5).

BOX 5: HOW IMPORTANT ARE FUEL TAXES TO THE COMPETITIVENESS OF AUTOGAS?

According to most recent edition of Autogas Incentive Policies – a joint annual report published jointly by the WLPGA and Liquid Gas Europe – the way in which Autogas is taxed vis-à-vis other fuels has an enormous impact on how competitive the fuel is and, by extension, its share of the overall market for automotive fuels (WLPGA/Liquid Gas Europe, 2018). In ten of the 25 countries surveyed in that report, Autogas pump prices per litre for private motorists were less than half those of gasoline in 2017. The price of Autogas as a proportion of that of gasoline ranged from 32% in Thailand to 104% in the United States, averaging 53% across all countries. Relative to diesel, the price of Autogas averaged 59%.

The wide variation in Autogas pump prices among the countries surveyed, both in absolute terms and relative to the prices of other fuels, mainly reflects differences in the way automotive fuels are taxed. Autogas taxes in 2017 were lower than those on gasoline on a per-litre basis in all the countries surveyed.

Autogas is totally exempt from excise taxes in China, India, Mexico and Russia. The ratio of Autogas taxes to gasoline taxes was by far the highest in the United States (though most users were able to profit from a small tax credit); in all the other countries, excise taxes on Autogas were less than half of those on gasoline on a per-litre basis.

The pump price of Autogas relative to diesel and gasoline, together with the relative cost of converting a vehicle to run on Autogas (taking account of any incentives), determines the distance that needs to be driven before that cost is paid back through lower running costs. In all the countries surveyed except the United States, converted vehicles eventually break even with gasoline vehicles. In most, it is less than 50 000 km. The equivalent breakeven distance for OEM Autogas vehicles is generally higher, because it is more expensive to buy an OEM than convert a gasoline car in most cases.

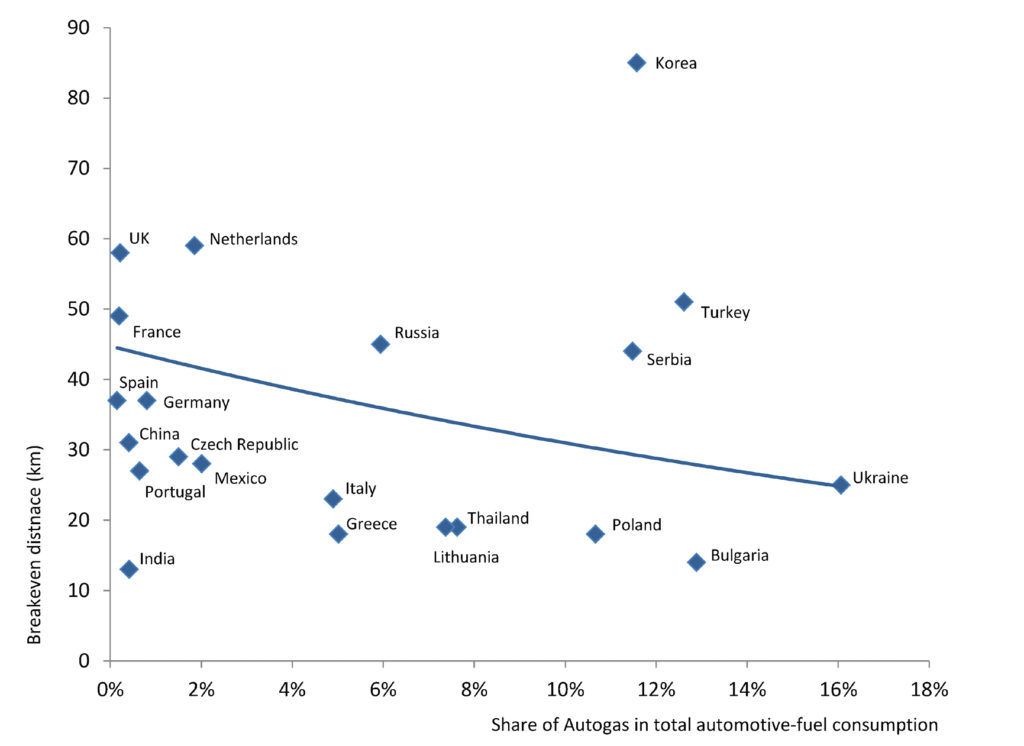

Experience shows very clearly that, the market penetration of Autogas is strongly correlated with the breakeven distance of Autogas vis-à-vis gasoline. Based on 2017 data on pump prices and vehicle costs, Autogas use and rates of market growth are generally highest in countries where the breakeven distance is lowest, especially against gasoline (Figure 7). In two-thirds of the countries surveyed, the breakeven distance against gasoline is under 50 000 km – or about three years of driving. At 14 000 km, Bulgaria has the second-lowest breakeven distance and one of the highest rates of market penetration for Autogas – 13%.

Autogas is most competitive in India, where a converted vehicle breaks even with gasoline at just 13 000 km – less than one year of driving for a private motorist. Autogas is also highly competitive in Bulgaria, Greece, Italy, Lithuania, Poland, Thailand and Ukraine, all of which have a breakeven distance of less than 25 000 km for a converted car and where the market penetration of Autogas is high. At the other extreme, Autogas is never competitive with either gasoline or diesel in the United States.

Figure 7: Autogas share of automotive-fuel consumption and breakeven distance against gasoline

Note: The breakeven distances shown are the lowest for each country (a converted or OEM vehicle). The United States is

not shown as Autogas is never competitive against gasoline. Australia, Canada and Japan are not shown as their breakeven

distances are off the scale at above 100 000 km. Breakeven distances are based on 2017 data and market shares on 2016 data.

Source: WLPGA/Liquid Gas Europe (2018)

“Experience shows very clearly that, the market penetration of Autogas is strongly correlated with the breakeven distance of Autogas vis-à-vis gasoline, which is determined by relative fuel prices and vehicle costs.”

Other factors drive the market penetration of Autogas and help to explain differences in recent rates of market growth across national markets. These include:

- Government policy commitment: The Autogas market has tended to develop more quickly where the government has shown a strong, long- term policy commitment in favour Autogas. Frequent changes of policy, including shifts in taxation, discourage end users, equipment manufacturers and fuel providers from investing in Autogas.

- Non-financial policies and measures: In some cases, the use of non-financial incentives or other measures such as public awareness campaigns run by the government – often in partnership with the Autogas sector – have helped to boost Autogas use. Mandates and public transport fleet conversion programmes have also been very successful in several countries, notably in China, India and the United States.

- Restrictions on diesel vehicles: Local and central government environmental restrictions on the use of diesel vehicles have been an important factor behind the success of Autogas in some countries, notably Korea and Japan. These restrictions are likely to become more widespread with growing concerns about the health effects of PM (soot) emissions from diesel vehicles, which could boost demand for Autogas.

- Availability of equipment and fuel: In some countries, Autogas has struggled to penetrate the fuel market where carmakers have been reluctant to market OEM models or where there is a limited number of refuelling sites selling Autogas. The issue of producing right- and left-hand drive vehicles complicates this.

- Public attitudes: Misconceptions about the safety and reliability of Autogas have clearly affected demand in several countries. For example, this appears to be one reason why Autogas demand remains weak in France, despite highly favourable taxation policies.

In the longer term, developments in vehicle technology will undoubtedly have a major impact on demand for Autogas. There are clear signs that the world is on the cusp of a road-transport revolution, with carmakers stepping up their research and development efforts in EVs and, to a lesser extent, hydrogen fuel cells, and launching new models. This is the result of recent advances in battery technology and stronger government incentives, driven largely by environmental concerns. The production of biofuels is also growing steadily. How quickly the transformation of energy use for transport takes place is a major uncertainty for the demand for Autogas and for road transport fuels generally. Ultimately, EVs may completely displace internal combustion engine (ICE)-based vehicles, including those fuelled by Autogas, but this will take decades. There will be opportunities for Autogas to replace gasoline and, in some cases, diesel in existing conventional vehicles during this period. Continuing advances in Autogas vehicle technology will be an important factor in exploiting these opportunities.