A Global Roadmap for Autogas

The role of alternative fuels

Reducing drastically the environmental impact of road transport in the face of rising demand for mobility will not be possible without a major shift to clean alternative automotive fuels. Continuing improvements in fuel economy will also be needed. Today, gasoline and diesel refined

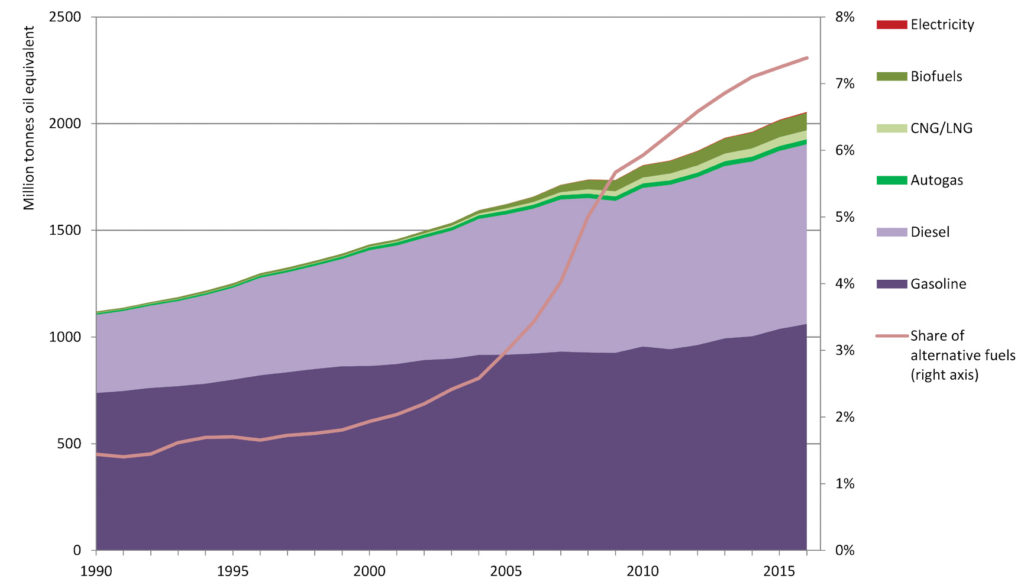

from crude oil still dominate the transportfuel mix in most parts of the world, though the share of alternatives, including Autogas, is growing rapidly:

in aggregate, they accounted for around 7% of total road-transport energy consumption in 2016, up from less than 2% in 2000 (Figure 3). Total consumption of alternative fuels was 42% higher in 2016 than in 2010 and almost five-and-a-half times higher than in 2000.

Figure 3: World energy consumption for road transport by fuel and share of alternative fuels

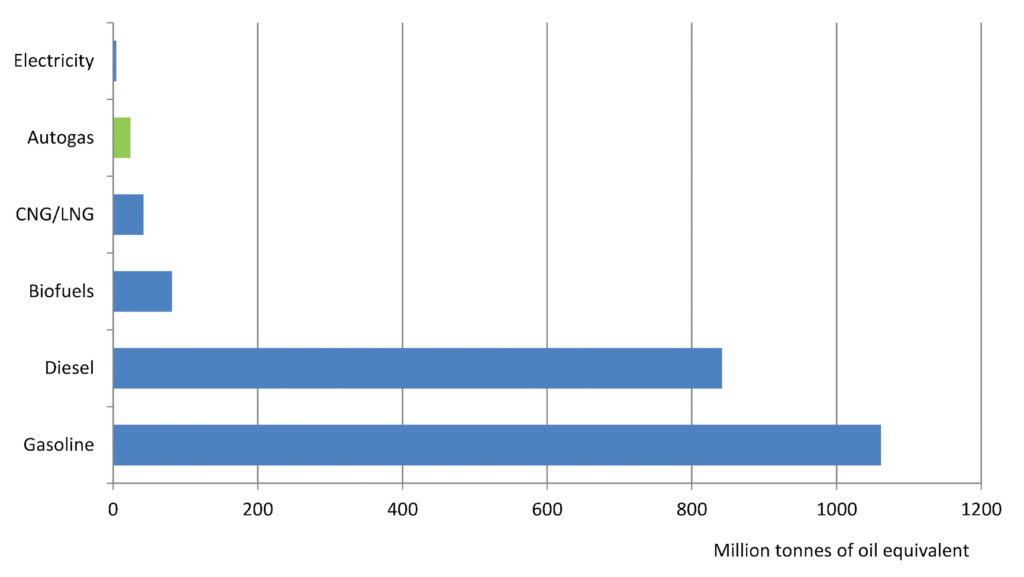

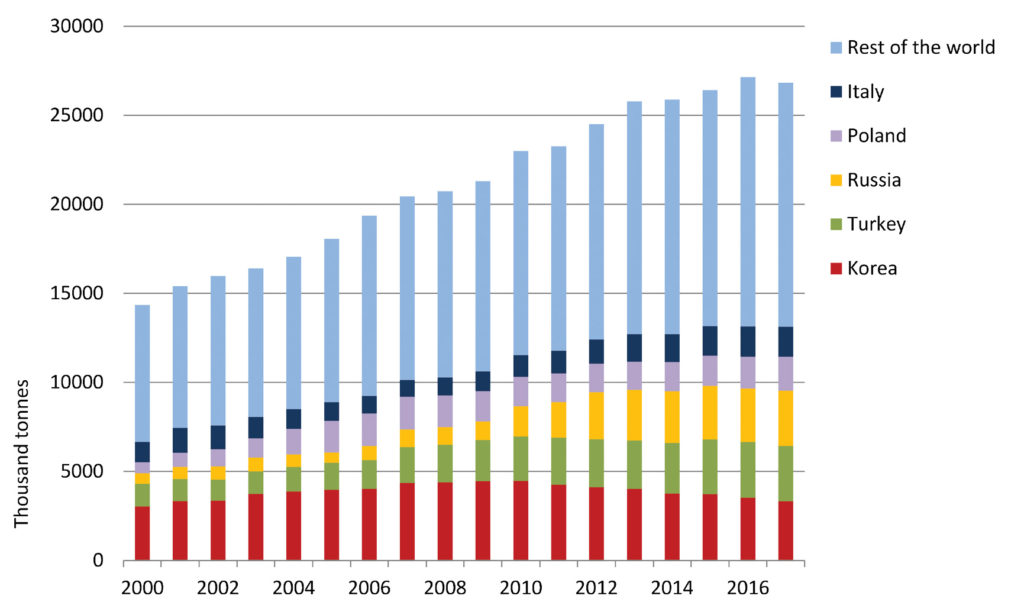

In volumes terms, Autogas is the leading unblended alternative fuel for LDVs and the second most important one for all vehicle types after natural gas, accounting for 1.2% of total fuel use. Autogas consumption worldwide has almost doubled since 2000 (Figure 4 and Figure 5). Yet Autogas use is still concentrated in a small number of countries: just five countries – Korea, Turkey, Russia, Poland and Italy – together accounted for under half of global Autogas consumption in 2017.

The share of Autogas in total automotive-fuel consumption varies widely across countries, ranging from a mere 0.1% in the United States to about one-fifth in Ukraine. Autogas makes up more than 10% of the automotive-fuel market in four other countries: Bulgaria, Korea, Poland and Turkey. The enormous disparity in the market penetration of Autogas is explained mainly by differences in the strength of government incentive policies (WLPGA/Liquid Gas Europe, 2018). There is considerable potential for expanding the role of Autogas in all countries.

“The enormous disparity in the market penetration of Autogas around the world is explained mainly by differences in the strength of government incentive policies.”

Figure 4: World energy consumption in the road transport sector

BOX 1: WHAT IS AUTOGAS?

Autogas is the abridged name for automotive liquefied petroleum gas (LPG) – that is, LPG used as an automotive transport fuel. LPG is the generic name for mixtures of hydrocarbons that change from a gaseous to liquid state when compressed at moderate pressure or when chilled. The chemical composition of LPG can vary, but is usually made up of predominantly propane and butane (normal butane and iso-butane). Autogas generally ranges from a 30% to 99% propane mix. In some countries, the mix varies according to the season as the physical characteristics of the two gases differ slightly according to ambient temperatures.

LPG is obtained either as a product from crude- oil refining or from natural-gas or oil production. At present, more than 60% of global LPG supply comes from natural gas processing plants, though the share varies markedly among regions and countries. With both processes, LPG must be separated out from the oil-product or natural-gas streams. LPG is generally refrigerated for large-scale bulk storage and seaborne transportation as a liquid, but it is transported and stored locally in pressurised tanks or bottles (cylinders). BioLPG – renewable LPG derived from production processes that use biomass as the feedstock, usually as a co- product – is an emerging source of LPG.

LPG has high energy content per tonne compared with most other oil products and natural gas, and burns readily in the presence of air. It is also a particularly good engine fuel and is highly portable. These characteristics have made LPG an increasingly popular fuel for domestic heating and cooking, commercial use and agricultural and industrial processes, as well for transport as an alternative automotive fuel.

Autogas has different names in different countries. It is known as propane in North America and LPG or GPL in some European and African countries. Whatever it is called, the proven advantages of the fuel are the same: it is clean, safe, practical, affordable, portable, flexible and readily available.

Figure 5: World Autogas consumption by country

The other main alternative fuels are biofuels, natural gas – in the form of compressed natural gas (CNG) or liquefied natural gas (LNG) – and electricity. Biofuels derived from vegetable matter such as ethanol or biodiesel, which are normally blended into conventional gasoline and diesel, have been making major inroads, their share of total automotive fuel consumption having risen eight-fold since 1990 to 4% in 2016 (Figure 3). But the scope for further increases in biofuel supply using conventional technology is likely to be limited by competition for land to grow food crops, as well as high production costs. Natural gas has also seen significant market growth, mainly for heavy-duty vehicles, though cost and fuel availability are constraining factors in many cases. Plug-in hybrids and pure battery EVs are now starting to be commercialised on a significant scale, boosting their share of total road transport energy use from just 0.1% in 2010 to an estimated 0.5% in 2018, but their attractiveness remains constrained for the moment by their high cost and limited driving range (Box 2). The prospects for hydrogen-powered fuel cells, the use of which remains negligible for now, hinge on major technological advances and cost reductions.

The increasing market share of alternative fuels is largely the result of government policies. The initial impetus for the development of alternative fuels came from the oil-price shocks of the 1970s, as countries sought to reduce their dependence on imports of crude oil and refined products. Environmental and health concerns have since overtaken energy security as the principal driver of government policies to promote such fuels, as they are generally less polluting. The main approaches that governments use are financial incentives, in the form of differentiated taxes and subsidies according to the type of fuel or vehicle, and regulatory measures, including emission standards, purchase mandates for public and/or private vehicle fleets and exemptions from city-driving restrictions. Other measures include support for technology development and public awareness programmes (Table 1).

BOX 2: EVs ARE COMING – BUT HOW QUICKLY?

The attention of vehicle manufacturers and policy makers is increasingly focused on EVs, as the cost of producing batteries falls and their performance improves, particularly with respect to driving distance between recharges. It is widely believed that EVs will largely replace vehicles based on internal combustion engines in the coming decades. So far, EV deployment has mostly been driven by policy. Many countries have introduced financial incentives or mandates for purchasing EVs. China, the leading market by volume, and Norway, where EVs have the biggest market share, have the strongest policy push.

Global sales of EVs hit a record 1.15 million in 2017, or 1.2% of total LDV sales, boosting the EV fleet to more than 3.1 million. That number could rise to about 15 million by 2020 and 125 million by 2030, based on current policy plans (IEA, 2018a). Faster deployment is possible, but that would require much bigger subsidies to reduce the cost of purchasing or owning an EV and/or stronger mandates. EVs still struggle to compete with established alternative fuel technologies – including Autogas – in the mainstream car market because of the high purchase price of the vehicle, the relatively low distance between recharges, the time required to fully recharge the battery and limited recharging infrastructure. For example, in the United Kingdom, where the authorities in some cities are encouraging taxis to switch to EVs in the taxi sector, there are objections from drivers on the working time lost due to the time it takes to recharge the battery, as well as the perceived health effects of being in close proximity to batteries for many hours a day. Batteries are currently the main reason of the higher upfront costs of EVs compared with other vehicles, though their cost is likely to continue to fall and their performance improve significantly in the next few years with economies of scale and further technological progress. Battery life and their disposal continue to pose economic and environmental challenges.

Table 1: Typology of government policies and measures to promote alternative fuels

| wdt_ID | Fiscal/financial | Regulatory | Other |

|---|---|---|---|

| 1 | Excise-duty exemption or rebate | Mandatory sales/purchase requirements for public and/or private fleets (with enforcement) | Government own-use of AFVs |

| 2 | Road/registration-tax exemption or rebate | Standards to harmonise refuelling facilities | Information dissemination and public awareness campaigns |

| 3 | Vehicle sales-tax exemption or income/profit tax credit (purchasers and OEMs) | Vehicle-conversion standards | Voluntary agreements with OEMs to develop and market AFV technologies |

| 4 | Tax credits for investment in distribution infrastructure and R&D | Coherent and appropriate health and safety regulations | Direct funding for research, development, demonstration and deployment of AFVs |

| 5 | Grants/tax credits for AFV conversion/acquisition. | Exemptions from city-driving restrictions | |

| 6 | Rapid depreciation for commercial purchasers of Autogas vehicles and owners of distribution infrastructure | ||

| 7 | Exemption from parking/roaduse charges |

Source: WLPGA/Liquid Gas Europe (2018).